Michael Saylor, CEO of MicroStrategy, is leading the charge in Bitcoin’s institutional adoption. Under his guidance, MicroStrategy has become a major corporate Bitcoin investor. The company now owns 439,000 BTC1. Their recent $1.5 billion Bitcoin purchase solidifies their role in corporate Bitcoin investment1.

MicroStrategy’s bold strategy has transformed the company. It now combines its software business with a massive investment portfolio. The software division brings in $75 million yearly1. Meanwhile, their Bitcoin investments have grown to $18.6 billion1.

This unique approach has caught attention. MicroStrategy will join the Nasdaq-100 index on December 231. This move highlights the growing importance of corporate Bitcoin adoption.

Key Takeaways

- MicroStrategy has become one of the largest institutional investors in Bitcoin, purchasing a total of 439,000 BTC.

- The company’s recent $1.5 billion Bitcoin purchase has solidified its position as a key player in the corporate Bitcoin treasury movement.

- MicroStrategy’s software division generates $75 million in annual revenue, while its Bitcoin investment portfolio has reached $18.6 billion.

- The company’s unique approach has earned it a spot on the Nasdaq-100 index, reflecting the growing significance of corporate Bitcoin adoption.

- Michael Saylor’s leadership has been instrumental in driving MicroStrategy’s Bitcoin investment strategy and raising awareness of cryptocurrency in the institutional sphere.

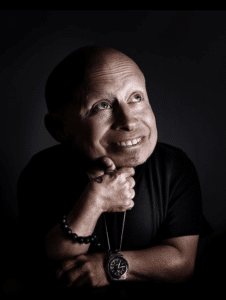

Overview of Michael Saylor’s Bitcoin Advocacy

Michael Saylor, MicroStrategy’s co-founder and executive chairman, is a key figure in the Bitcoin world. He’s invested heavily in BTC through his company. Saylor passionately promotes cryptocurrency’s transformative potential2.

Background on Michael Saylor

Saylor’s tech and business background shapes his view on Bitcoin’s financial role. His experience as an entrepreneur gives him insight into disruptive technologies. This knowledge informs his understanding of how Bitcoin can reshape industries3.

Saylor’s Vision for Bitcoin

Saylor sees Bitcoin as more than just corporate treasury management. He believes it can change how companies and institutions preserve and grow wealth4.

Saylor argues that Bitcoin could become a digital gold standard. He predicts its market cap could reach over $280 trillion4.

| Metric | Value |

|---|---|

| BlackRock’s IBIT ETF Assets Under Management | $57.8 billion |

| Bitcoin ETF Inflows in Two Weeks | Over $5.5 billion |

| MicroStrategy’s Bitcoin Holdings | 402,100 BTC ($40 billion) |

| Bitcoin All-Time High | $108,268 |

Saylor’s Bitcoin advocacy goes beyond his company’s investments. He’s offered to advise on cryptocurrency policies at high government levels3. His vision for Bitcoin’s global financial role has gained many followers.

Saylor has become a leading voice in the BTC institutional accumulation trend2. His ideas have sparked interest among investors and policymakers alike.

“Bitcoin is the most powerful and disruptive technology I’ve ever encountered in my 35-year career.”

– Michael Saylor, Co-founder and Executive Chairman of MicroStrategy

The Rise of Bitcoin in Institutional Portfolios

Institutional interest in Bitcoin is growing rapidly. Companies like MicroStrategy are leading this trend. Investors see Bitcoin as an inflation hedge and valuable asset5.

This has sparked “institutional FOMO” among companies. Many are considering Bitcoin to avoid missing out on the digital asset revolution6.

Reasons for Institutional Interest

Bitcoin’s popularity among institutional investors stems from several factors. It serves as a hedge against inflation, especially during economic uncertainties6.

Bitcoin’s resilience as a store of value has caught corporate leaders’ attention. Many are now looking to diversify their portfolios with this digital asset5.

Key Examples of Institutional Investments

- MicroStrategy has invested over $4 billion in Bitcoin. It’s now one of the largest corporate holders of this digital asset5.

- Tesla made headlines in 2021 with a $1.5 billion Bitcoin investment. They later used it to purchase goods and services6.

- Square, led by Jack Dorsey, has allocated part of its treasury to Bitcoin. This move further legitimizes Bitcoin as a mainstream financial asset6.

These high-profile investments have inspired other companies. More publicly traded firms are now considering Bitcoin in their investment strategies6.

“Bitcoin is considered a global macro asset worth trillions, leading many to believe every investor should have some exposure to it.”

As more companies embrace Bitcoin, its potential grows. This could lead to a significant influx of institutional capital into the cryptocurrency market6.

Saylor’s Contribution to Bitcoin Awareness

Michael Saylor, MicroStrategy’s co-founder and Executive Chairman, champions Bitcoin. His public appearances and media efforts boost Bitcoin awareness among investors and corporate leaders.

Public Appearances and Interviews

Saylor frequently appears on podcasts and media outlets to educate about Bitcoin. He shared his journey from skeptic to maximalist on ICR’s ‘Welcome to the Arena’ podcast.

Investors can listen to Saylor’s podcast on Apple Podcasts and Spotify. New episodes come out every two weeks since August 20217.

Saylor highlights the need for supportive regulations in Bitcoin’s growth. His clear explanations of complex ideas help make the case for corporate Bitcoin investments.

Media Strategies and Content Creation

Saylor has a broad media strategy to spread Bitcoin’s message. MicroStrategy, the world’s largest Bitcoin Treasury Company, creates content to educate the public7.

Through these efforts, Saylor has become a trusted source of Bitcoin information. He’s helping increase Bitcoin acceptance in the corporate world.

Saylor blends deep knowledge with easy-to-understand communication. This makes Michael Saylor Bitcoin evangelism and corporate treasury topics more accessible.

“Bitcoin is the most widely held and most adopted cryptocurrency in the world, and MicroStrategy is the first public company to make Bitcoin a primary treasury reserve asset on its balance sheet.” – Michael Saylor

Saylor’s efforts have boosted Bitcoin’s mainstream acceptance, especially among corporations. He’s helped position Bitcoin as a strong alternative to traditional investments.

His work paves the way for more institutional adoption of Bitcoin7. Saylor’s dedication has made Bitcoin a compelling option for diversifying treasury holdings.

MicroStrategy’s Bitcoin Investment Journey

MicroStrategy leads corporate Bitcoin adoption. Their bold move to convert cash reserves into Bitcoin has greatly impacted their stock price. This decision has changed how the market views the company8.

MicroStrategy now holds $46.02 billion worth of Bitcoin. This makes them one of the largest corporate cryptocurrency holders. Their aggressive strategy has yielded an unrealized profit of over $18.9 billion8.

In December, MicroStrategy bought over $3 billion of BTC above $100,000. This shows their strong belief in Bitcoin’s future potential8.

MicroStrategy’s Bitcoin investment has been incredibly successful. Their stock price has soared 460% year-to-date. The company is now among the top 100 publicly traded US firms8.

MicroStrategy will announce its next earnings report between February 3 and 5, 2025. A blackout period in January may affect their ability to issue convertible debt for Bitcoin purchases8.

Despite potential short-term limits, MicroStrategy remains committed to Bitcoin investment. CEO Michael Saylor has bought about 439,000 Bitcoins worth $46 billion for the company9.

This bold move has made MicroStrategy a leader in crypto adoption. It has inspired other states and countries to explore similar strategies9.

MicroStrategy’s journey shows how companies can use Bitcoin as a store of value. It serves as a hedge against inflation. Their future plans likely include more investments in cryptocurrency9.

The Role of Bitcoin as Digital Gold

Bitcoin is often called digital gold due to its similarities with the precious metal. Its scarcity, with only 21 million coins ever to be created, makes it valuable. Bitcoin’s durability and portability attract institutional investors looking for an inflation hedge10.

Characteristics Comparing Bitcoin and Gold

Bitcoin and gold share key traits: scarcity, durability, and verifiability. However, Bitcoin offers unique advantages like divisibility and easy transportation. These features have contributed to Bitcoin’s growing acceptance as a digital store of value, comparable to the role of gold in traditional finance.

The Inflation Hedge Argument

Bitcoin’s potential as an inflation hedge drives growing institutional interest. Investors seek alternatives to traditional currencies amid unprecedented monetary policies11. Bitcoin’s fixed supply and independence from government control make it appealing for wealth protection.

Many companies now include Bitcoin in their treasury strategies. MicroStrategy, for example, actively buys BTC to hedge against inflation.

“Bitcoin is digital gold – harder, stronger, faster, and smarter than physical gold. And Bitcoin will surpass gold as the preferred store of value of the 21st century.”

– Michael Saylor, CEO of MicroStrategy

Challenges Facing Institutional Bitcoin Adoption

Institutional investors face big hurdles in Bitcoin adoption. Regulatory uncertainty is a major issue. In Australia, ASIC took legal action against Binance for misclassifying clients12.

ASIC fined Kraken’s Australian operator $12.8 million for breaches. They also canceled Binance’s Australian financial services license in April 202312.

Regulatory challenges exist beyond Australia. In South Korea, lawmaker Kim Nam-kuk faces jail for hiding crypto holdings12. This creates a complex landscape for institutions interested in Bitcoin.

Market Volatility and Risk Management

Bitcoin’s market volatility is another big challenge. Institutions need strong risk management strategies. They must carefully allocate portfolios and mitigate risks13.

El Salvador’s IMF loan deal shows Bitcoin-related risks. A survey revealed 92% of Salvadorans don’t use Bitcoin for transactions13. This shows a gap between institutional interest and public use.

Overcoming these challenges is key for widespread Bitcoin adoption. Learn more about the institutional Bitcoin FOMO and Bitcoin corporate balance.

The Future of Bitcoin in Corporate Strategies

Publicly traded companies are increasingly adopting Bitcoin. Financial analysts are split on its long-term role in corporate strategies1. Some predict widespread adoption, while others warn of potential volatility and risks.

Predictions from Financial Analysts

Michael Saylor’s Bitcoin investments have far-reaching implications for companies. Analysts warn of increased balance sheet volatility due to Bitcoin’s fluctuating value14. Companies may need new strategies to manage digital assets effectively.

Supporters argue that Bitcoin can hedge against inflation. It also offers a diversified asset portfolio14. As more companies follow MicroStrategy’s lead, financial asset management may change significantly1.

| Metric | Value |

|---|---|

| MicroStrategy’s Total Bitcoin Holdings | 1 439,000 BTC |

| Recent Bitcoin Purchase by MicroStrategy | 1 $1.5 billion |

| MicroStrategy’s Annual Software Revenue | 1 $75 million |

| MicroStrategy’s Total Investment Revenues | 1 $18.6 billion |

Bitcoin’s role in corporate strategies remains hotly debated. Financial regulations, market volatility, and potential benefits will shape future corporate landscapes14. The impact of Bitcoin adoption is still unfolding.

“The adoption of Bitcoin by publicly traded companies is a significant shift in the financial landscape, and its long-term implications are still unfolding. As more organizations embrace digital assets, the need for innovative financial management strategies will become increasingly crucial.”

Bitcoin investments by public companies are drawing widespread attention. This trend could dramatically change how businesses handle finances and allocate assets11415. The future of corporate finance looks increasingly digital.

Saylor’s Insights on Bitcoin’s Global Acceptance

Michael Saylor, Bitcoin evangelist and MicroStrategy Inc. co-founder, sees Bitcoin’s role expanding beyond a store of value. He believes Bitcoin could become a widely accepted payment method for large, cross-border transactions16.

Using Bitcoin in international commerce offers compelling advantages. These include reduced costs, faster settlements, and bypassing traditional banking systems. Such features could greatly benefit companies operating across multiple countries16.

Saylor’s insights show his deep grasp of Bitcoin’s transformative power. As institutions keep accumulating BTC, it’s set to dominate international finance and commerce.

“Bitcoin has the potential to revolutionize the way we think about and conduct cross-border transactions. Its unique features make it an attractive option for businesses and individuals alike.”

Saylor’s vision for Bitcoin’s adoption as a payment method reflects his Michael Saylor Bitcoin evangelism. The ongoing BTC institutional accumulation is paving the way for Bitcoin’s global acceptance.

This pioneering cryptocurrency is poised to reshape the financial landscape. Its growing acceptance could lead to significant changes in how we handle money globally.

Public Perception of Michael Saylor’s Influence

Michael Saylor’s impact on the Bitcoin community is both inspiring and controversial. As MicroStrategy’s Executive Chairman, he’s become a fierce Bitcoin advocate. Saylor transformed from a skeptic to a self-proclaimed “Bitcoin maximalist.”7

Community Reactions to His Advocacy

Saylor’s Bitcoin advocacy has gained strong support from cryptocurrency enthusiasts. Many see his corporate strategy as a powerful endorsement of their beliefs7.

MicroStrategy’s bold move to become the “world’s first and largest Bitcoin Treasury Company” has cemented Saylor’s leadership. This decision has further strengthened his reputation in the cryptocurrency space7.

Saylor’s Relationship with Critics

Some view Saylor’s enthusiasm as too aggressive for a public company. Critics worry about exposing shareholders to volatility and uncertainty7.

Despite criticism, Saylor remains firm in his beliefs. He engages in open debates to address concerns about Bitcoin in corporate finance7.

Michael Saylor’s influence in the Bitcoin ecosystem is undeniable. His prominent appearances and widespread coverage prove this7.

Saylor’s unwavering commitment to Bitcoin has made him a key figure. He’s central to discussions on cryptocurrency’s institutional adoption and potential to disrupt finance7.

“Bitcoin is the most superior monetary network ever created, and I intend to make it the core of my corporate strategy.”

– Michael Saylor, Executive Chairman of MicroStrategy7

Conclusion: The Lasting Impact of Saylor’s Bitcoin Investments

Michael Saylor’s Bitcoin investments through MicroStrategy have transformed the cryptocurrency landscape. His advocacy and large-scale Bitcoin accumulation have driven institutional adoption. This has paved the way for integrating digital assets into corporate finance strategies17.

Summary of Key Points

Saylor’s visionary approach has shaped the mainstream narrative around cryptocurrency. His public appearances and media outreach have been crucial in this effort.

MicroStrategy has become a trailblazer, accumulating over 130,000 Bitcoins. It now serves as a model for companies looking to diversify with digital assets1718.

Final Thoughts on the Future of Bitcoin

Saylor’s strategy may be seen as a turning point for broader institutional Bitcoin adoption. The interplay between corporate strategy and cryptocurrency continues to reshape finance.

Saylor’s influence guides businesses seeking to tap into digital assets’ potential. His impact will likely be felt for years to come1718.